- Joined

- Feb 16, 2025

- Messages

- 50

- Thread Author

- #1

Fauz Wolfe/Ministry of Justice, Prosecution

v.

Dayvon Bennett, Defendant

Criminal Complaint:

On August 1st, the Defendant inquired with the Minister of Urban Development, asking if she had interest in opening an account with his bank. She reminded the Defendant of the need to register. The Defendant acknowledged this need, and then solicited the Minister again two days later. He has also already taken money from other individuals under the pretense that his bank is, in fact, a bank, when it is not legally registered as one.

Parties:

1. Prosecution, Fauz Wolfe

2. Co-Counsel, Lysander Lyon

3. Defendant, Dayvon Bennett

Factual Allegations:

1. Dayvon Bennett was informed of the need to register his bank in Exhibit A.

2. Dayvon Bennett knew his bank did not receive registration from the Ministry of Economic Affairs, seen in Exhibit B.

3. Dayvon Bennett has continued to operate his company as a bank, soliciting and taking clients, and having the company falsely registered as a bank in-game to dodge taxation.

Evidence:

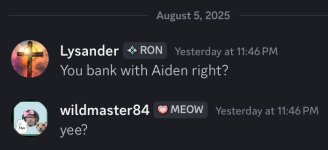

Exhibit A: Conversation with the Minister of Urban Development.

Exhibit B: This shows Dayvon Bennet attempting to register his bank, but being rejected. The reply with the Bulletin channel explains that no new financial institutions will be registered until the Rebuild Banking Act receives royal assent, see Exhibit C.

Exhibit C: The bulletin message referenced in the above exhibit.

Exhibit D: Further solicitation of MUD Minister to open an account.

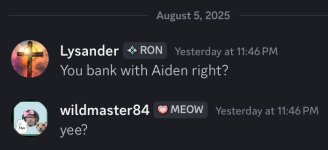

Exhibit E: Omreta_Bank’s client, warranting the second charge of criminal fraud.

Exhibit F: Balance of Omreta_Bank, proving tax evasion.

Legal Claims:

1. The Defendant has knowingly engaged in at least two counts of Criminal Fraud, defined in the criminal code as “the act of intentionally deceiving or misleading another person or entity for financial gain.”

2. The Defendant has also engaged in Enterprise Tax Evasion, using this false bank to avoid paying taxes on a significant sum of capital in-game.

3. The Defendant’s extensive criminal record warrants full punishment from the court.

Prayer For Relief:

1. A ruling charging the Defendant with two counts of Criminal Fraud and one count of Enterprise Tax Evasion, with the maximum jail time of 60 minutes and a fine of $3,000.

2. Punitive damages in the amount of $3,000, for knowingly engaging in this behavior.

Verification:

I, Fauz Wolfe, hereby affirm that the allegations in the complaint AND all subsequent statements made in court are true and correct to the best of my knowledge, information, and belief and that any falsehoods may bring the penalty of perjury.

v.

Dayvon Bennett, Defendant

Criminal Complaint:

On August 1st, the Defendant inquired with the Minister of Urban Development, asking if she had interest in opening an account with his bank. She reminded the Defendant of the need to register. The Defendant acknowledged this need, and then solicited the Minister again two days later. He has also already taken money from other individuals under the pretense that his bank is, in fact, a bank, when it is not legally registered as one.

Parties:

1. Prosecution, Fauz Wolfe

2. Co-Counsel, Lysander Lyon

3. Defendant, Dayvon Bennett

Factual Allegations:

1. Dayvon Bennett was informed of the need to register his bank in Exhibit A.

2. Dayvon Bennett knew his bank did not receive registration from the Ministry of Economic Affairs, seen in Exhibit B.

3. Dayvon Bennett has continued to operate his company as a bank, soliciting and taking clients, and having the company falsely registered as a bank in-game to dodge taxation.

Evidence:

Exhibit A: Conversation with the Minister of Urban Development.

Exhibit B: This shows Dayvon Bennet attempting to register his bank, but being rejected. The reply with the Bulletin channel explains that no new financial institutions will be registered until the Rebuild Banking Act receives royal assent, see Exhibit C.

Exhibit C: The bulletin message referenced in the above exhibit.

Exhibit D: Further solicitation of MUD Minister to open an account.

Exhibit E: Omreta_Bank’s client, warranting the second charge of criminal fraud.

Exhibit F: Balance of Omreta_Bank, proving tax evasion.

Legal Claims:

1. The Defendant has knowingly engaged in at least two counts of Criminal Fraud, defined in the criminal code as “the act of intentionally deceiving or misleading another person or entity for financial gain.”

2. The Defendant has also engaged in Enterprise Tax Evasion, using this false bank to avoid paying taxes on a significant sum of capital in-game.

3. The Defendant’s extensive criminal record warrants full punishment from the court.

Prayer For Relief:

1. A ruling charging the Defendant with two counts of Criminal Fraud and one count of Enterprise Tax Evasion, with the maximum jail time of 60 minutes and a fine of $3,000.

2. Punitive damages in the amount of $3,000, for knowingly engaging in this behavior.

Verification:

I, Fauz Wolfe, hereby affirm that the allegations in the complaint AND all subsequent statements made in court are true and correct to the best of my knowledge, information, and belief and that any falsehoods may bring the penalty of perjury.