- Joined

- Jun 30, 2024

- Messages

- 69

- Thread Author

- #1

Nim Surname, Plaintiff, represented by Lyon Law

v.

Vanguard National Bank, Defendant

Civil Complaint:

On February 12th, the Plaintiff found out that his accounts with the Defendant had been frozen. The Defendant informed the Plaintiff that there were, and I quote, "suspicious transactions" related to his accounts, and that they had frozen his accounts without prior notice. The Defendant wrongly alleges that they have this power in relation to his account holding Azalean Dollars, incorrectly applying Terms of Service for different activities across accounts.

This serves as a clear material breach of contract, as the Defendant has deliberately refused to allow the Plaintiff access to his property in a manner not consistent with the contracts the two parties agreed to that serve as the Terms of Service and User Agreements. Vanguard National Bank, the Defendant, does not have the right to freeze a client's assets, violating their own Terms of Service, simply because they do not wish to give him the funds in his account.

This case is brought forward to resolve this manner, and restore the Plaintiff immediate access to his Azalean funds.

Parties:

Plaintiff - Nim Surname, represented by Lysander Lyon

Defendant - Vanguard National Bank

Factual Allegations:

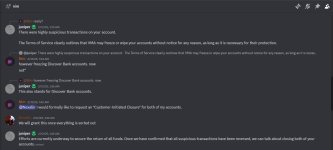

1) The Plaintiff was not notified of the freeze on his accounts, nor the suspicious transactions, until he opened a ticket on February 12th at 1:04am. Exhibit A shows the opening of this customer support ticket, while Exhibit B shows the notification of the freeze.

2) Vanguard National Bank did not close the Plaintiff's account, but froze its ability to make transactions. This is shown in Exhibit B, where the Plaintiff is told his accounts were frozen.

3) The Plaintiff was never asked to verify his transaction activity.

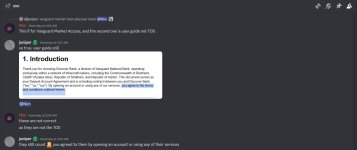

4) Both the Plaintiff and Vanguard National Bank are bound by the contracts that are the Terms of Service and the User Guides. This is both general law, and specifically pointed out by the Defendant in Exhibit C, where it is stated that these become binding upon use of service.

5) The Vanguard Market Access Terms of Service state that VMA can freeze accounts in its sole discretion. Exhibit D is a downloaded copy of the Vanguard Market Access ToS; this statement is present at section 12(d) of the ToS.

6) The Vanguard Market Access Terms of Service state that the word "accounts" shall be defined within the document as "the VMA accounts you have opened through connecting your discord that are subject to the terms, conditions, and agreements in this Booklet..." This is present under the Definitions section in Exhibit D.

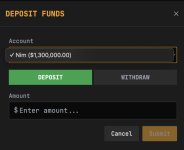

7) The account the Plaintiff holds his Azalean Dollars in is not connected to the Vanguard Market Access system. This is shown in Exhibit E.

8) The Discover Bank User Guide states "Customers will be notified of any suspicious transactions and may be asked to verify their activity." This is shown in Exhibit F, a downloaded copy of the Discover Bank User Guide, in the second bullet point under section 7.1.

9) The Discover Bank User Guide states "Discover Bank reserves the right to close accounts at its discretion..." This is shown in Exhibit F, under section 8.1.

10) The words "freeze" and "frozen" do not appear once in the Discover Bank User Guide, nor are any similar terms used in relation to allowing Discover Bank to freeze an individual's transactions. This is shown in Exhibits G and H.

11) The Plaintiff has not been provided an estimated time of completion for when his account's funds will be released to him.

12) The Plaintiff has been provided no details as to Vanguard National Bank's "investigation," and no representation in the process.

Legal Claims:

1) The Vanguard Market Access Terms of Service, by their own definition, do not cover the Plaintiff's non-linked Discover Bank account. This is clearly proven through Exhibits D and E.

2) There is nothing in the Discover Bank Terms of Service or User Guide that allows the Defendant to unilaterally freeze the Plaintiff's account. This is shown through Exhibits F, G, H, and I, with Exhibit I being a copy of the Discover Bank ToS.

3) Thus, the Defendant has deliberately acted outside of the scope of the contracts mutually agreed to by the Defendant and the Plaintiff, resulting in a material breach of contract.

4) The Plaintiff has been unable to access his funds for multiple days, which has inhibited his ability to participate in Azalean society.

Prayer for Relief:

1) An Asset Preservation Order from the court, to prevent the Defendant from interacting with the Plaintiff's assets in any way that could compromise the funds in his account that holds the Azalean Dollars.

2) A ruling that Vanguard National Bank has committed a material breach of their contractual obligations, that orders the immediate unfreezing of the Plaintiff's assets and transfer to his person.

3) Compensatory damages in the amount of $5,000, to cover the harm incurred to the Plaintiff for being unable to access his funds for a week.

4) Special damages in the amount of $10,000, to cover the attorney's fees the Plaintiff would not have incurred without the Defendant's actions.

5) Payment by the Defendant of all court fees incurred by the Plaintiff.

Verification:

I, Lysander Lyon, hereby affirm that the allegations in the complaint AND all subsequent statements made in court are true and correct to the best of the plaintiff's knowledge, information, and belief and that any falsehoods may bring the penalty of perjury.

Exhibit I, a copy of the Discover Bank ToS, is linked here - https://docs.google.com/document/d/11AV8lJjEgRY3FLbEXQAWYZlle0MLld7_5kzXcjT3jYI/edit?usp=sharing

v.

Vanguard National Bank, Defendant

Civil Complaint:

On February 12th, the Plaintiff found out that his accounts with the Defendant had been frozen. The Defendant informed the Plaintiff that there were, and I quote, "suspicious transactions" related to his accounts, and that they had frozen his accounts without prior notice. The Defendant wrongly alleges that they have this power in relation to his account holding Azalean Dollars, incorrectly applying Terms of Service for different activities across accounts.

This serves as a clear material breach of contract, as the Defendant has deliberately refused to allow the Plaintiff access to his property in a manner not consistent with the contracts the two parties agreed to that serve as the Terms of Service and User Agreements. Vanguard National Bank, the Defendant, does not have the right to freeze a client's assets, violating their own Terms of Service, simply because they do not wish to give him the funds in his account.

This case is brought forward to resolve this manner, and restore the Plaintiff immediate access to his Azalean funds.

Parties:

Plaintiff - Nim Surname, represented by Lysander Lyon

Defendant - Vanguard National Bank

Factual Allegations:

1) The Plaintiff was not notified of the freeze on his accounts, nor the suspicious transactions, until he opened a ticket on February 12th at 1:04am. Exhibit A shows the opening of this customer support ticket, while Exhibit B shows the notification of the freeze.

2) Vanguard National Bank did not close the Plaintiff's account, but froze its ability to make transactions. This is shown in Exhibit B, where the Plaintiff is told his accounts were frozen.

3) The Plaintiff was never asked to verify his transaction activity.

4) Both the Plaintiff and Vanguard National Bank are bound by the contracts that are the Terms of Service and the User Guides. This is both general law, and specifically pointed out by the Defendant in Exhibit C, where it is stated that these become binding upon use of service.

5) The Vanguard Market Access Terms of Service state that VMA can freeze accounts in its sole discretion. Exhibit D is a downloaded copy of the Vanguard Market Access ToS; this statement is present at section 12(d) of the ToS.

6) The Vanguard Market Access Terms of Service state that the word "accounts" shall be defined within the document as "the VMA accounts you have opened through connecting your discord that are subject to the terms, conditions, and agreements in this Booklet..." This is present under the Definitions section in Exhibit D.

7) The account the Plaintiff holds his Azalean Dollars in is not connected to the Vanguard Market Access system. This is shown in Exhibit E.

8) The Discover Bank User Guide states "Customers will be notified of any suspicious transactions and may be asked to verify their activity." This is shown in Exhibit F, a downloaded copy of the Discover Bank User Guide, in the second bullet point under section 7.1.

9) The Discover Bank User Guide states "Discover Bank reserves the right to close accounts at its discretion..." This is shown in Exhibit F, under section 8.1.

10) The words "freeze" and "frozen" do not appear once in the Discover Bank User Guide, nor are any similar terms used in relation to allowing Discover Bank to freeze an individual's transactions. This is shown in Exhibits G and H.

11) The Plaintiff has not been provided an estimated time of completion for when his account's funds will be released to him.

12) The Plaintiff has been provided no details as to Vanguard National Bank's "investigation," and no representation in the process.

Legal Claims:

1) The Vanguard Market Access Terms of Service, by their own definition, do not cover the Plaintiff's non-linked Discover Bank account. This is clearly proven through Exhibits D and E.

2) There is nothing in the Discover Bank Terms of Service or User Guide that allows the Defendant to unilaterally freeze the Plaintiff's account. This is shown through Exhibits F, G, H, and I, with Exhibit I being a copy of the Discover Bank ToS.

3) Thus, the Defendant has deliberately acted outside of the scope of the contracts mutually agreed to by the Defendant and the Plaintiff, resulting in a material breach of contract.

4) The Plaintiff has been unable to access his funds for multiple days, which has inhibited his ability to participate in Azalean society.

Prayer for Relief:

1) An Asset Preservation Order from the court, to prevent the Defendant from interacting with the Plaintiff's assets in any way that could compromise the funds in his account that holds the Azalean Dollars.

2) A ruling that Vanguard National Bank has committed a material breach of their contractual obligations, that orders the immediate unfreezing of the Plaintiff's assets and transfer to his person.

3) Compensatory damages in the amount of $5,000, to cover the harm incurred to the Plaintiff for being unable to access his funds for a week.

4) Special damages in the amount of $10,000, to cover the attorney's fees the Plaintiff would not have incurred without the Defendant's actions.

5) Payment by the Defendant of all court fees incurred by the Plaintiff.

Verification:

I, Lysander Lyon, hereby affirm that the allegations in the complaint AND all subsequent statements made in court are true and correct to the best of the plaintiff's knowledge, information, and belief and that any falsehoods may bring the penalty of perjury.

Exhibit I, a copy of the Discover Bank ToS, is linked here - https://docs.google.com/document/d/11AV8lJjEgRY3FLbEXQAWYZlle0MLld7_5kzXcjT3jYI/edit?usp=sharing

Attachments

-

Nim Lawsuit Exhibit A.jpg85.7 KB · Views: 36

Nim Lawsuit Exhibit A.jpg85.7 KB · Views: 36 -

Nim Lawsuit Exhibit B.jpg87.9 KB · Views: 27

Nim Lawsuit Exhibit B.jpg87.9 KB · Views: 27 -

Nim Lawsuit Exhibit C.jpg79.9 KB · Views: 29

Nim Lawsuit Exhibit C.jpg79.9 KB · Views: 29 -

Nim Lawsuit Exhibit D.pdf958.7 KB · Views: 2

-

Nim Lawsuit Exhibit E.png51.9 KB · Views: 27

Nim Lawsuit Exhibit E.png51.9 KB · Views: 27 -

Nim Lawsuit Exhibit F.pdf192 KB · Views: 2

-

Nim Lawsuit Exhibit G.jpg89 KB · Views: 27

Nim Lawsuit Exhibit G.jpg89 KB · Views: 27 -

Nim Lawsuit Exhibit H.jpg90.1 KB · Views: 31

Nim Lawsuit Exhibit H.jpg90.1 KB · Views: 31